OneBlinc is an online loan-based website that lets employees borrow loans using different valuable services. This platform gives a seamless device access facility to get innovative loans at the end of your salary anywhere and anytime. After filling in some information, users get fast-lightning approval and can deposit loans simultaneously.

It provides a friendly interface allowing users to access or browse various content using multiple devices, including Windows, Android, iOS, Linux, iPhone, iPad, and Apple Watch. OneBlinc offers a convenient browsing experience with an internet connection and can automatically generate your login.

Moreover, it creates your account, connects you with different banks, and allows you to approve a loan within minutes. It has valuable features like customization of return date, funds for federal employees, expedited loan applications, and more.

This application ensures users can apply anytime with a single click and use this site without the hassle of going anywhere. It offers the easiest way to quickly apply for and deposit loans and can sort out their financial issues in minutes. So, to get excellent podcast content, visit our website or check out the posts containing the best alternatives, like OneBlinc.

Features

- Seamless browsing experience

- Friendly interface

- Free to use

- Easy payment plans

- A push that builds your credit store

Similar to OneBlinc

There are up to 24 OneBlinc Alternatives. It has features like Loan and Online. The best alternative to 24-oneblinc-alternatives is Activehours, which is Paid. The other best apps like 24-oneblinc-alternatives are Even, Payactiv and FlexWage.

Pricing

OneBlinc Information

24 Best OneBlinc Alternatives

Filter Alternatives

1Fig Loans

Fig Loans is a web-based solution providing a marketplace that can help its users who have banked with less credit experience. This platform can let its clients get emergency loans along with multiple products regarding financial stability. It can even permit its customers to access the loan with a suitable structure to help them return it with elementary methods compared to formal lenders. Fig loans also come with facilitating its users to get a loan by completing an online app…

2DailyPay

DailyPay is a web-based marketplace that can help its users with the proposals on request pay rates in any organization. This platform can let its clients access the least demanding & most secure method for getting their acquired wages before payday. It can even permit its customers to reserve, implying less time spent stressing over funds and additional time spent on what makes the most significant difference. DailyPay also has an impressive set of tools, so users can consider among…

Advertisement

3Chime

Chime is a type of online platform, which comes to the customer with having a core mission to create financial peace of mind into a reality. This platform is growing rapidly, as it contains advanced technology that deals with allowing digital banking services to the client, which is very helpful as well as easy, and free for him, because it wants to get profit for its members, instead of taking from them. The model of Chime didn’t even rely on…

4SoFi Invest

SoFi Invest provides a secure and reliable way to invest in cryptocurrency while keeping track of everything intuitively. SoFi: Investing & Trading App delivers a safe environment for trading and investing, accompanied by tools that extend beyond simple stock trading features. You can begin investing right away using your smartphone and potentially win up to $1,000 in free stock.

Advertisement

SoLo Funds: Lend and Borrow is a peer-to-peer lending platform where users can borrow money for emergency expenses without fees or interest. It connects borrowers with lenders from around the world, making it an easy, efficient alternative to traditional bank loans.

Hundy: Money When You Need It is a free finance app developed by Hundy, Inc., designed to help users get quick deposit advances from people around them. There’s no need for a lengthy credit application.

Advertisement

Empower: Instant Cash Advance is an app by Empower Finance that provides users with up to $250 in cash advances with no interest. The app also offers weekly deals that allow users to save money, including up to 10% cashback on online shopping.

FloatMe: Payday Cash Advance is a finance app that allows users to access their unpaid earnings before payday, helping to prevent overdrafts and manage finances. By connecting your bank account to the app, you can access funds without asking your employer to speed up your paycheck.

Klover: Cash Advance Instant is a free app developed by Klover Holdings, providing users with instant access to their earned money for free. Simply link your bank account to the app to gain immediate cash access and track your budget for better financial management.

10CashNetUSA

CashNetUSA is a free financial app from Enova International, Inc., designed to help users manage their credit and access installment loans. The app also lets users request refunds, check their balance, and make payments, providing a convenient way to handle your line of credit.

Albert: Banking on You is a comprehensive financial app from Albert Corporation that offers budgeting, saving, investing, and banking services. With guidance from expert money advisors, users can create tailored financial portfolios to meet their goals, including managing credit cards, student loans, and investments.

Affirm is an online tool for making your shopping easy and relax by making transactions smoother. There are a lot of apps which are used for shopping but you feel baffled due to their tire-some complexities and hidden charges. While Affirm has a motto to be transparent and provide real worth of its price to the customer. On this app, you can choose stores to buy all things needed in your life. It has divided products of stores into different…

13FlexWage

Flexwage consolidates bill management into a single platform, allowing users to pay bills, view balances, and transfer funds seamlessly.

14Payactiv

PayActiv gives users early access to earned wages, offering financial flexibility for those living paycheck to paycheck.

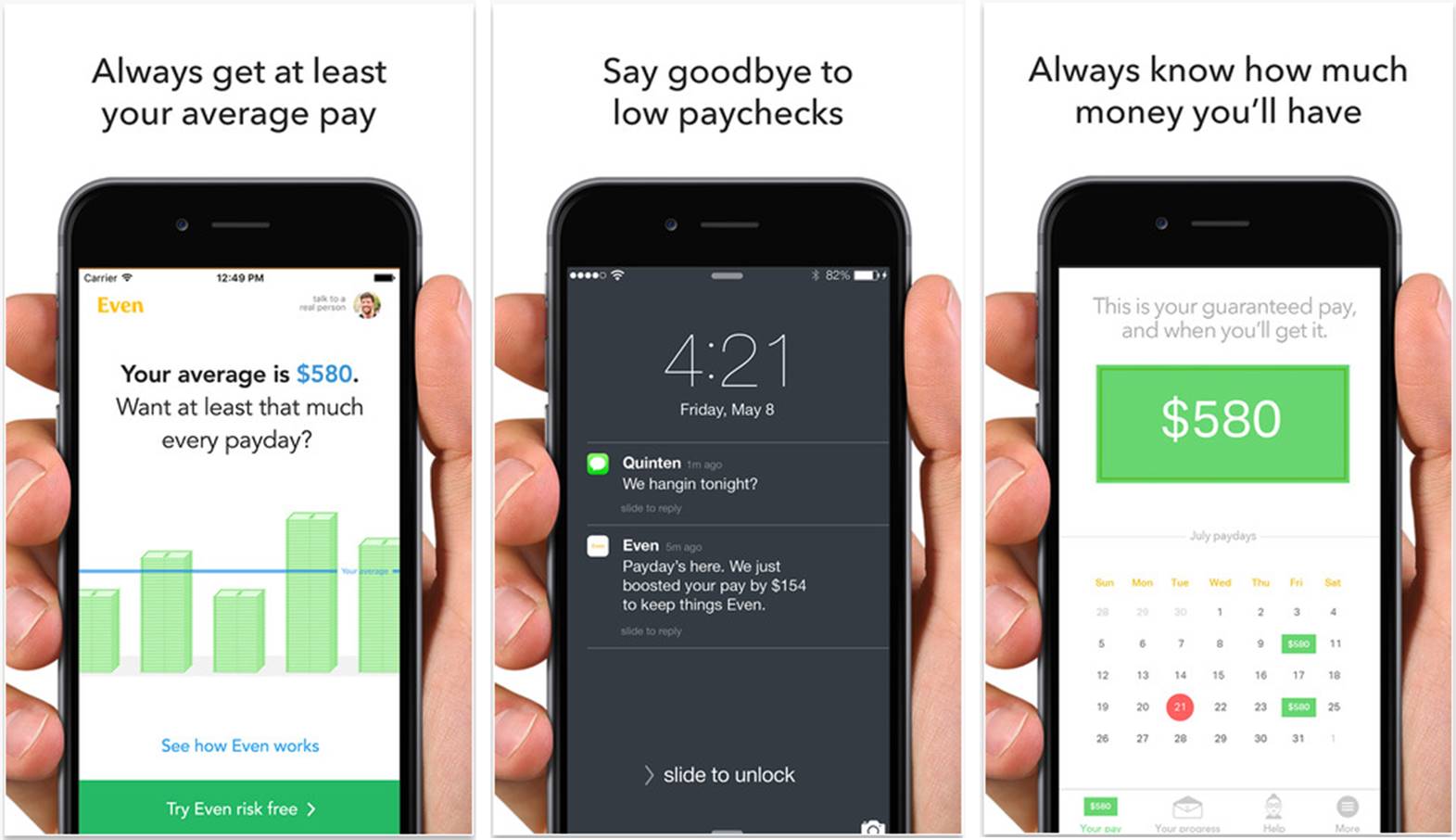

15Even

Even simplifies financial management by calculating expenses, creating savings buffers, and preventing overspending for better money management.

Payday Loans & Cash Advance offers quick cash loans by matching users with the best options based on their information.

17Ingo Money

Ingo Money enables users to cash checks instantly by uploading photos of their checks for approval.

18MoneyLion

MoneyLion provides financial assistance with no-interest loans and features like a fee-free Debit Mastercard for seamless transactions.

19Brigit

Brigit helps users manage finances with cash advances up to $250, eliminating overdraft and late fees.

20Branch

Branch offers secure financial solutions, letting users borrow money anytime without late payment fees or complicated processes.

21Earnin

Earnin provides instant cash advances up to $500, helping users handle expenses like medical bills and avoid overdraft fees.

22Dave

Dave offers $100 cash advances with minimal effort, assisting users in covering regular expenses without financial stress.

23Activehours

Activehours simplifies cash advances, ensuring quick access to funds before the next paycheck. It's a reliable app for those needing financial flexibility.