The popularity of cryptocurrency is increasing day by day as several businesses and individuals are using it for their business growth. Additionally, the anonymity of cryptocurrencies has made them an attractive option for criminals looking to launder money and conduct financial activities.

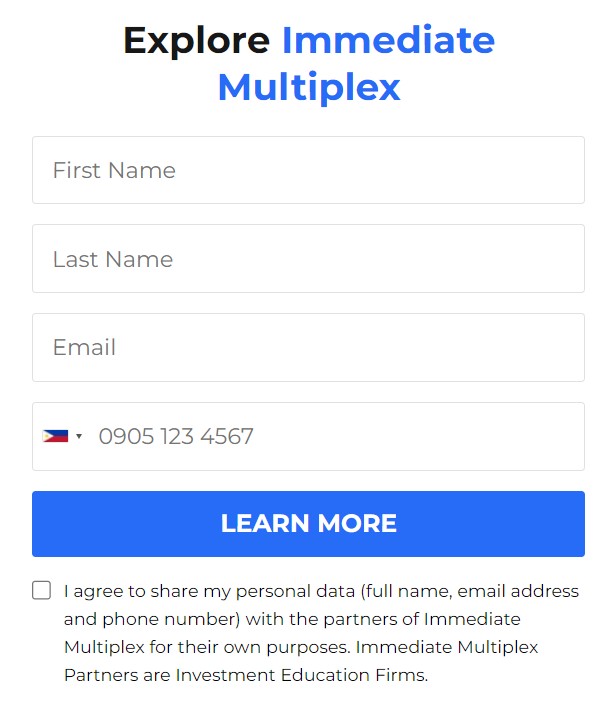

The scandals that occurred in the cryptocurrency industry have gained worldwide attention. Due to this the enforcement agencies and financial organizations are pressured to keep an eye on these digital assets. Click the image below to start Bitcoin trading.

The popularity of the Plus Token Ponzi Scheme

While the Plus token scheme was running in 2019, it had earned about $ 2.8 billion of which 65 percent of the money was covered through cryptocurrency crimes. The Ponzi scheme of Plus Crypto is an interest-returning investment program. Although the scheme was ended in July 2019. Thereafter the executive of the plus crypto Ponzi scheme re-announced the plan and withdrew about $ 3.5 billion in cryptocurrency.

Due to this scam, the crypto prices were reduced drastically in 2019. Moreover, tokens have a lot of followers, especially from Korea and China. Even those investors who were fresh on the crypto world also prefer plus tokens to invest. This is the interest rate between 10 to 19 percent per month.

The reasons behind Thodex Scand

A recent scandal was observed in Turkey, where the cryptocurrency exchange itself has announced that its website will not provide service due to some undergoing work to make the platform better.

It was specified that Thodex CEO Özer obtained a $ 3 billion grant from 3, 94,000 investors. A lot escaped abroad. A lot of Turkish users have filed illicit complaints because they represented themselves as victims of the exit plan as they were also aware that the stolen funds were irreversible in the lawful process.

Memorable Silk Road Scandal

One more scandal took place as it was considered the biggest scam of the dark web’s biggest marketplace as it was executed by a person named, Ross Ulbricht. Although he was also arrested in 2013 on account of money laundering, drug trafficking, etc. due to which he was supposed to have sold millions of dollars in drugs in the form of cryptocurrency through the Silk Road exchange.

Also See: Sites Like Crypto Viewer

Challenges have to be faced in Regulating Cryptocurrency for AML/CFT

Certain challenges have to be faced by the Regulatory Cryptocurrency due to below-said reasons:

- Absence of Regulatory Consistency: Crypto is being used across borders and it is very difficult to implement the regular AML of CFT regulations. Moreover, some countries allow regulations in crypto whereas some do not.

- Features of Anonymity and Pseudonymity: Crypto transactions occurring on the network either can be anonymous or pseudonymous due to which the possibility to identify which of two persons are involved in the transaction, becomes very difficult. Criminals took advantage of this situation to pursue their illegal tasks

- The complexity occurred in the technical part: although crypto transactions are such a complicated task for regulators. Although it is possible to reserve cryptocurrency wallets offline, it becomes difficult to track the actual transaction stats.

- The immediate emergency of the latest cryptocurrency makes it very close to being implicated for regulators to maintain the altering landscape and implement the regulations.

Also See: Best Crypto Coins To Invest In 2023

Conclusion

However, a lot of crypto candles created problems for crypto users and investors. But to overcome these challenges, more robust AML and CFT are being made by the regulators for the benefit of cryptocurrency. Although it will take a lot of time to implement the regulations that are helpful to establish a healthy balance between the requirement of transparency along innovative ideas for cryptocurrency.