Financial assets like stocks are traded daily, and investors must have tools to analyze them. Technical analysis is the ability to analyze trends and trading patterns in stocks.

Stocks, ETFs, options, currencies, crypto, and other investment vehicles can be traded based on charts and other analysis tools. Trading decisions should be based on technical analysis and trading tools rather than emotion.

The tools they provide also generally include educational materials to help investors maximize their use of the information they provide. The advice most financial advisors give is to buy and hold rather than to trade frequently.

They suggest this because frequent trading can be dangerous, especially when less experienced. These are some examples of the best trading platforms, including Day Trading Bitcoin, that you can use for trading analysis of your trading.

Moreover, investing your time and money in Day Trading Bitcoin is Worth It whole experience. Check out some of the most popular options below to help you decide which options are best.

1. TradeStation

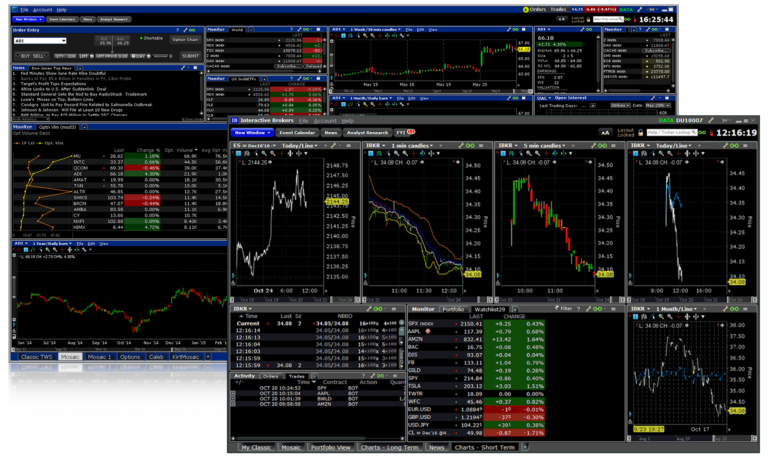

With TradeStation, traders get fast execution and access to high-quality market data. Over the past few years, TradeStation, which serious traders traditionally used, has begun to cater to casual traders.

A variety of features are offered to investors, including powerful trading technology for quick trade executions, market data, and online brokerage services. Trading stocks, ETFs, options, futures, and cryptos are possible with TradeStation.

Trading simulation tools, which allow traders to test ideas before turning them into actual trades, are also included. Charting and analysis tools provide cutting-edge charting and analysis tools.

You can trade stocks, ETFs, futures, and stock options without paying a commission. Traders can also test options strategies with OptionsStation Pro, while Portfolio Maestro allows portfolio risk assessment using backtested holdings.

2. Interactive Brokers

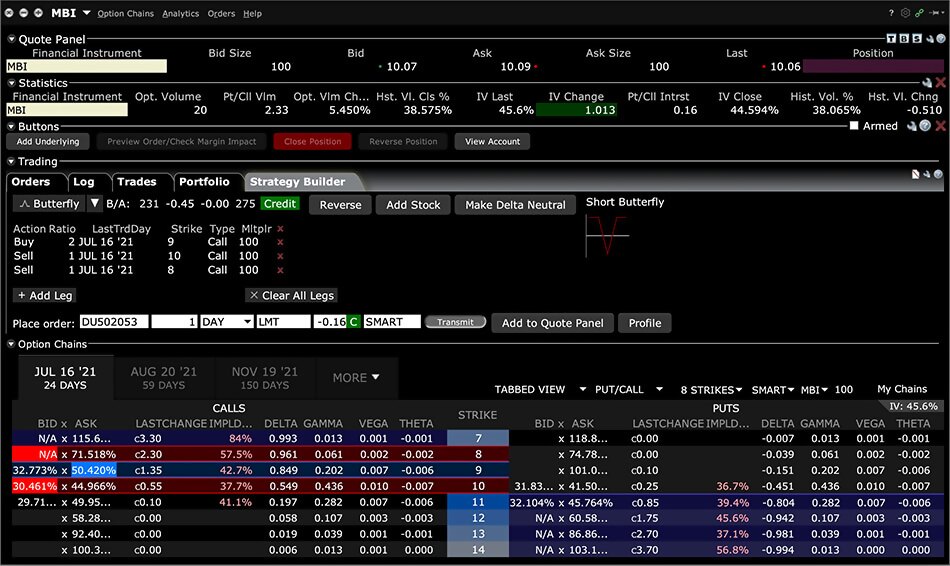

Trades can access a wide range of research tools, calculators, and other information through Interactive Brokers’ brokerage platform. It offers a downloadable platform for traders called Trader Workstation.

With Interactive Brokers, you can access a wide variety of trading tools, education resources, research reports, and calculators to help you make better trading decisions.

One of the most significant advantages of using this platform is that you can invest in various assets. Among them are stocks, ETFs, options, mutual funds, spot gold in the United States, hedge funds, a robo advisor, and managed portfolios.

In addition to margin trading, Interactive Brokers offers good research tools and charting tools, as well as reasonable commissions.

3. TradingView

In addition to its charting platform, TradingView also serves as a social network for traders with over 30 million members. Global stocks, currencies, and cryptocurrencies are tracked through over 100 market indicators.

You can screen stocks based on fundamentals, economics, and finance with the platform, just like you would with pricier alternatives. Besides just covering U.S. markets, Trading Tools covers global stocks as well.

A free trial is offered with subscriptions ranging from $15 to $60 per month. Besides providing a range of features and data, TradingView also enables immediate stock tracking.

The software may be flawed for day traders; however, swing traders and investors will be able to benefit from the software’s capabilities for creating watchlists and for using price action analysis as a tool.