Wealthfront Investing is a web-based marketplace that can provide users with a financial place that integrates investing and banking services, aiming to prioritize individuals over institutions. This platform lets millions of clients get a Cash Account with 4.55% APY, automated investment into personalized, diversified portfolios, commission-free stock investing, and tax-loss harvesting.

It can even permit customers to access the app that can help them to combine their financial views and track wealth-building towards retirement. Wealthfront Investing is also highly rated and recognized by Nerd Wallet and Investopedia as a top robo-advisor and cash management platform. There is even availability to democratize wealth management, making complex financial operations accessible and straightforward via automation.

Features

- Offers a variety of low-cost ETFs

- Known for its user-friendly interface

- Automated investment management platform

- Focuses on passive & long-term investing strategies

- Provides portfolio rebalancing and tax-loss harvesting

Pros

- Low-cost robo-advisor

- High-interest cash accounts

- Free financial planning tools

- Tax-efficient investing strategies

- Automated portfolio management

Cons

- No mutual funds

- No fractional shares

- Limited human advice

Similar to Wealthfront Investing

There are up to 16 Wealthfront Investing Alternatives for several platforms, including Playstore. The best alternative to 16-wealthfront-investing-alternatives is Betterment, which is Paid. The other best apps like 16-wealthfront-investing-alternatives are GnuCash, UnkleBill and Moneydance.

Pricing

Wealthfront Investing Information

16 Best Wealthfront Investing Alternatives

Filter Alternatives

1Zoe Financial

Zoe Financial is an online platform providing users with a wealth planning place connecting clients with the country's top 5% of advisors, using innovative technology and exceptional service for personalized wealth growth. This platform lets its clients get advisors who pass a strict examination process, ensuring dedicated guidance to clients. It can even permit its customers to access the network of Wealth Planners, backed by notable institutions and operators, who share an independent belief in a better approach to managing…

2Ellevest

Ellevest, founded by Wall Street powerhouse Sallie Krawcheck refers to the platform that can provide users with an investing place specifically designed for women, currently managing billions in assets. This platform lets its clients get personalized investment portfolios based on individual money goals, whether for buying a home, starting a business, or planning retirement. It can even permit its customers to access portfolios that withstand market volatility, utilizing tax minimization strategies and automatic rebalancing. Ellevest also offers impact portfolios that…

Advertisement

3FutureAdvisor

FutureAdvisor, founded in 2016, deals with a solution-based platform through which users can have a digital wealth management firm that leverages software to provide affordable, accessible wealth management to mass-rich investors. This platform lets clients get a firm that prioritizes transparency, convenience, and inclusivity, offering portfolio management tools previously inaccessible to middle- and working-class families. It can even permit its customers to access education counseling, course selection guidance, visa assistance, and pre-departure briefing for international students. FutureAdvisor also has a…

4Harness Wealth

Harness Wealth refers to the marketplace offering users a financial advisory place specialized in helping startup employees manage their equity and crypto assets. This platform lets thousands of clients get an interactive dashboard to visualize financial status, project future profits or taxes, and provide expert advice when needed. It can even permit customers to access vetted tax, financial, and estate advisors experienced in company equity, crypto, acquisitions, and IPOs. Harness Wealth offers personalized advice, considering individual portfolios, stock options, life…

Advertisement

5Betterment

Betterment is a well-rounded investment platform offering a fully customizable experience suited for both experienced investors and beginners. Betterment: Investment App offers quick sign-up, expertly curated investment portfolios, a minimum deposit of just $10, lower annual fees, automated trading tools, personalized financial advice, and tax-saving features.

6Money Manager Ex

Money Manager Ex is an easy-to-use personal finance manager that helps users track expenses and income. It offers a simple interface for creating monthly budgets and managing various categories like healthcare, food, and education.

Advertisement

7You Need a Budget

You Need a Budget is a user-friendly financial management tool designed to help users organize their incomes and transactions. It allows the addition of separate accounts and ensures expenses are properly tracked, with data accessible via the cloud from any device.

8Mint

Mint is a web-based finance management tool that consolidates all your financial accounts into one place. It automatically categorizes transactions, helps schedule payments, and provides custom alerts for unusual charges, making it easy to stay on top of your finances.

9HomeBank

HomeBank is a practical and reliable tool for managing your finances, tracking expenses, and monitoring payees and accounts. Its simple user interface helps you organize multiple accounts and financial data efficiently. It provides recommendations for better understanding your income and expenses.

10moneyGuru

moneyGuru is a personal finance management application designed to help you better manage your finances and schedule your income. It allows you to analyze cash flow and easily record your expenses. The polished interface is user-friendly, helping you track how money flows in and out. It also offers tools for scheduling periodic income, specifying details like payee, recurrence rate, and additional notes, giving you comprehensive control over your financial management.

11Moneydance

Moneydance is a full-featured financial management application that allows you to stay on top of your general financial trends, transaction records, and budget. It includes tools for bill payments, online banking, and investment monitoring, helping you manage multiple accounts simultaneously.

12Grisbi

Grisbi is a detailed personal finance application that helps you manage your expenses, budgets, and transactions while also generating reports. It supports multiple currencies, platforms, and comes with simple accounting features. Grisbi allows for automatic data backups at customizable intervals and offers backup creation before file saving.

13UnkleBill

UnkleBill is a user-friendly financial tool designed to create budget accounts, manage transfers, and generate financial reports. Users are required to create secure accounts with usernames and passwords, and the tool supports easy management of transfers and reports. You can select from preset currency symbols and track your financial progress over specific periods.

14Quicken

Quicken is a comprehensive personal finance software that allows users to easily manage their finances, monitor purchases, and connect to banks. It provides fast access to information about savings, loans, credit cards, and investments.

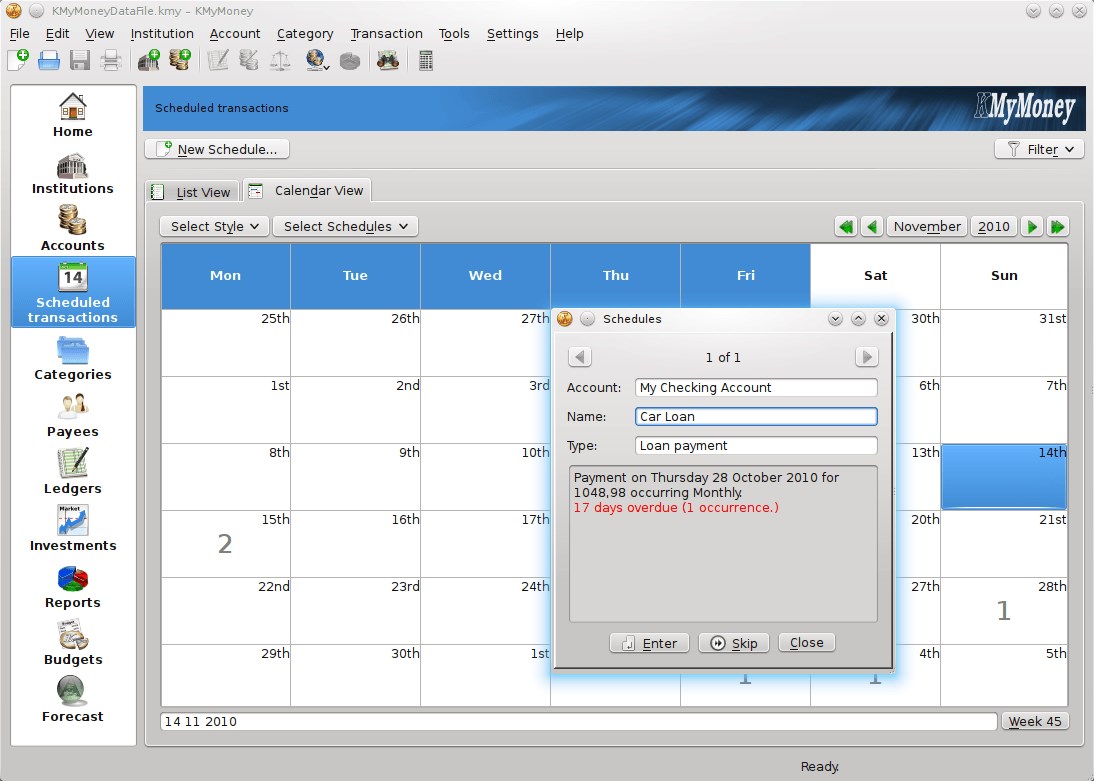

15KMyMoney

KMyMoney is a robust financial management tool that allows you to monitor revenues and expenses, track financial accounts, and generate reports. The tool features an intuitive toolbar, side panels for easy navigation, and extensive customization options.

16GnuCash

GnuCash is a comprehensive finance management tool that enables users to handle transactions, manage accounts, and generate detailed reports. With simple importing/exporting options, it’s ideal for both personal and small business accounting.