If you talk about the critical assets of the present world, the only name lurking around your mind would be Cryptocurrencies. Now, when one talks about all the famous Cryptocurrencies in the 21st century, the one name popping into every mind is none other than Bitcoin. Click this image below to start bitcoin trading.

If you have been tired of listening to the Bitcoin gossip and rumors that your peers talk about a whole day, then it is time for you to show interest in the same field. Bitcoin first came to the market in 2009, holding the hands of the famous yet mysterious figure, Satoshi Nakamoto.

However, after introducing the white papers of Bitcoins in the world, the mastermind vanished in 2011, leaving the masses with a lot of curiosity and questions. That is when the potential investors found scopes on the Bitcoin investments, and the groups followed the famous investors, of course!

Though many people in today’s world still consider Bitcoin to be in its growing or budding phase, people still need to catch up on their investments due to the luring game of earning huge profits.

If you are stuck in a dilemma on choosing Bitcoin as your primary investment platform, here are a few tips and tricks to help you improve your trading game.

Things to keep in mind while investing in Bitcoins

Choosing a suitable investment platform is one of the most important among all essential things in life. However, the heavy competitiveness in the market has led to the birth of various media in both the fiat and the virtual currency world. If you need to know whether to rely on the Cryptocurrency segment, then the following tips will help you develop a firm belief in the Crypto realm.

- Never forget to choose a fair exchange.

Right after investing your valuable assets in the crypto realm, most new investors delve into the thought of gains and cashing out problems. of the most common ones is Cryptocurrency exchanges. Before examining each of the exchanges, you should know that hundreds and thousands of Cryptocurrency exchanges are present in the present world. Choosing one among so many is daunting for you. To help you with your choice, you need to delve into the research and studies for an excellent comparison among the shortlisted ones.

- Figure out ways of cashing out

Cryptocurrency investment and trading fields are available in each corner of the world. But when it comes to cashing out, several options exist, but there is no guarantee that your country or state ought have the same options available everywhere. Crypto regulations are different in different countries. Hence, it would help if you researched the rules and regulations that your government bodies have made for virtual currencies. Then you can search for the various options available for cashing out, like searching for reliable exchanges, looking for nearby Bitcoin ATMs available, etc.

Read More: How are NFTs not quite the same as Cryptographic Money?

- Do not forget to study tech charts

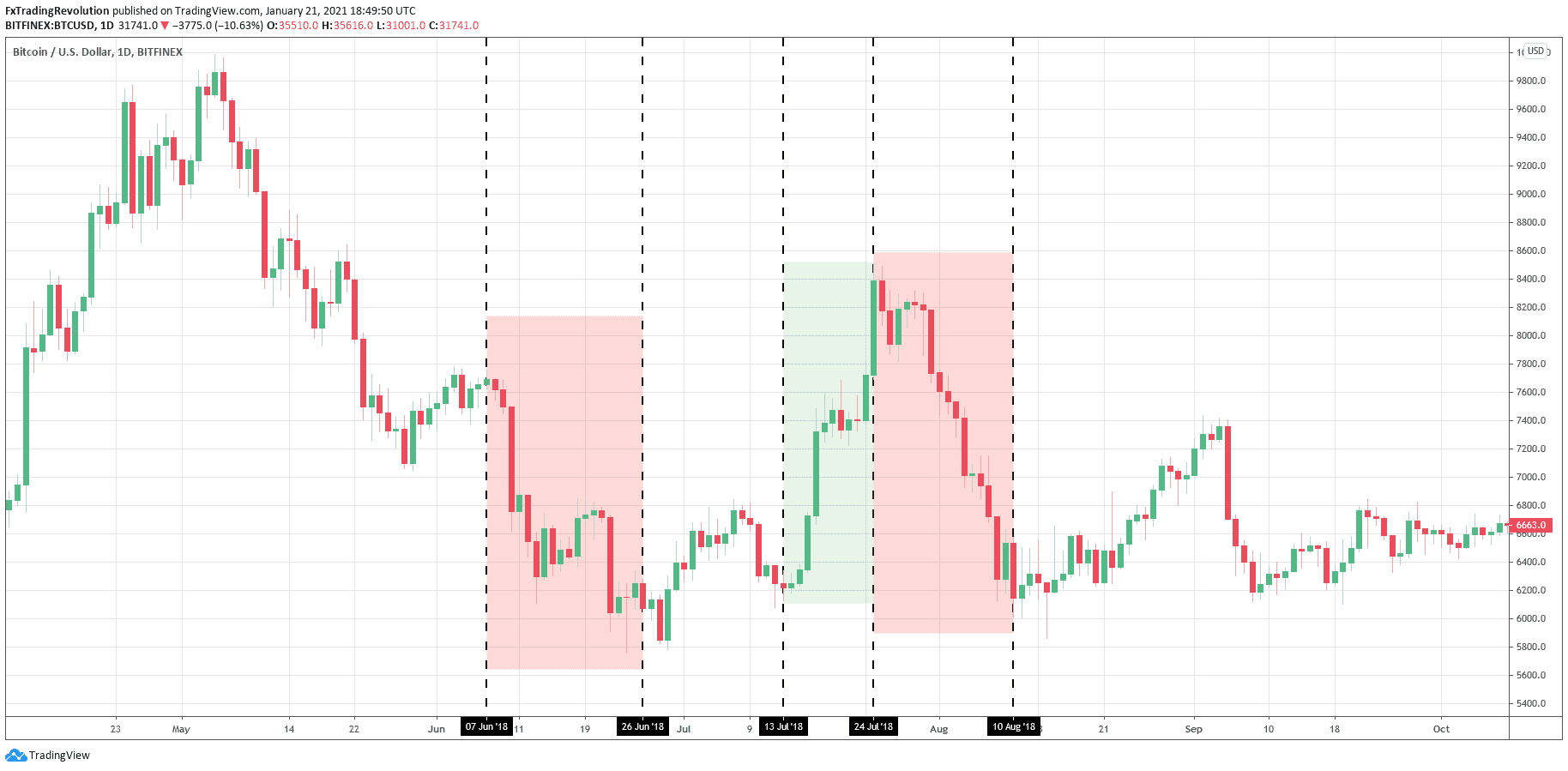

Every exchange and trading platform gives you access to research about the present rates and price changes in the market cap of the selected Cryptocurrencies. Thus, it would help if you took a peek into the market prices and the roller coaster ups and downs in the market caps of all the famous crypto coins available. You need to know how to read and observe tech charts consisting of green and red candles indicating price fluctuations in the trade market. Once after getting an idea of the coins which might give you significant profits, you should invest in them to avoid huge losses.

- Learn to deal with volatility

Every new investor in the Crypto realm should know that the market is a volatile one. It means that each Cryptocurrency’s market caps and prices keep on fluctuating with time. It is also the case where you invest a considerable chunk of your assets in a particular coin while running in profits. However, by the end of the day, you might face a massive loss due to the sudden price fall. If you want to avoid such circumstances, you can invest only 5% of your budgeted amount.

Conclusion

Now that you know the secrets behind a successful investor in the Crypto world, it is time for you to focus on the above points and implement them in your crypto trading journey.