The most well-known example of decentralised finance is Bitcoin. A financial institution or just one entity does not control the transactions that consumers use Bitcoin for. Instead, anyone can keep the more extensive database that records the transactions or create, confirm, or examine associated records.

Owners of Bitcoin who wish to access DeFi frequently opt to use wrapped Bitcoins like WBTC. As a result, they can now employ tokens that are linked straight to Bitcoin. You can also carry out trading via exchange platforms. An excellent example of a reliable platform is bitcodes ai.

The Defi platform is progressing with time on Ethereum and other undertaking platforms. However, numerous bitcoin owners also want to participate. As a result, several tools have been developed to assist Bitcoin holders in investing in DeFi.

How does bitcoin work as a DeFi application?

Bitcoin owners must utilise a token, such as Wrapped Bitcoin (WBTC). This type of Bitcoin can function on multiple blockchains as a 1/1 copy of bitcoin. Like any other digital asset that runs on the Ethereum network, the WBTC ER-20 is generally utilized by people on different platforms. A Bitcoin owner may use a platform like Uniswap to convert their BTC & then, as per their will, can borrow other similar coins using their WBTC as collateral. The DeFi ecosystem is then replenished with those stablecoins.

The WBTC utilised as security can be changed into cash, a hazard associated with this method. Like Bitcoin, Stacks is a layer-1 autonomous blockchain. The method is used to connect both networks. Miners must transfer Bitcoins to the Bitcoin network to be able to mine Stacks. One activity on the Bitcoin network can have numerous equivalents on the network.

Here’s some Bitcoin DeFi projects:

- Wrapped Bitcoin or WBTC – An ERC-20 token on the Ethereum network secured by an equal amount of bitcoin stored in a digital safe and linked to the same price as the top currency, Bitcoin.

- Ren VM – a platform that allows cryptocurrencies, including bitcoin, to be wrapped and sent to other platforms using the RenBridge.

- Stacks – this is also an independent layer-1 blockchain application linked to the bitcoin system, supporting a range of decentralised.

Challenges to bitcoin DeFi

Because of Bitcoin’s limited programming language, which also serves as its strength, DeFi has historically proven challenging. Bitcoin is difficult to program. The lack of intelligent contracts functionality in the Bitcoin ecosystem is on purpose. It was a deliberate trade-off to guarantee Bitcoin’s security and dependability as a decentralised store of wealth.

Developers have built alternative Bitcoin assets that need centralised counterparties or other blockchains containing wrapped BTC to address this problem. Wrapped Bitcoin, however, is not the same thing as Bitcoin, and several Bitcoiners are sceptical about the security and decentralisation of distinct blockchain systems or one-party custody schemes. There is a demand for Bitcoin DeFi-like solutions on centralised alternatives, but until recently, true Bitcoin DeFi was unbreakable.

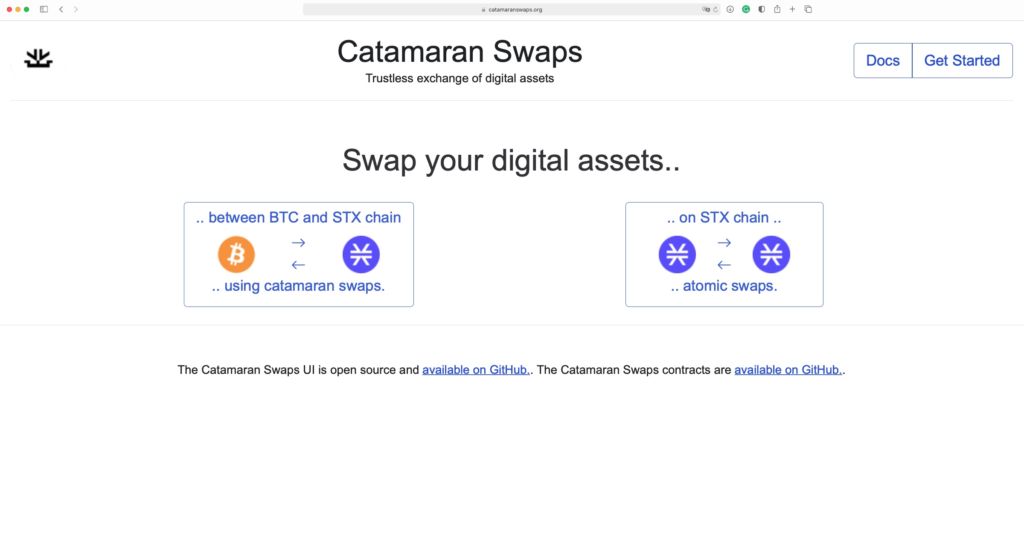

What are Catamaran Trustless Swaps?

A functioning Bitcoin swap with agreements that have unprecedented visibility into the state of Bitcoin was released by the Stacks community developers last month. These contracts allow action in Stacks-based intelligent contracts to be driven by only Bitcoin transactions. These transactions, which are referred to as “Catamaran swaps,” show the vast potential applications made possible by Stacks. These swaps are trustless, which means they are carried out without the aid of a private entity or custodial service.

This Catamaran swap application depends on a different Clarity contract that validates that a specific Bitcoin was mined at a particular block on the Bitcoin network. The submitted block details’ hash is matched to the hash that can be seen using Clarity’s block info method to execute the verification.

Then, the Merkle root of the validated block is matched to the Merkle root of the Bitcoin transaction along with the provided Merkle proof. The Bitcoin transaction was undoubtedly included within the block on the Bitcoin network if their hashes were equal.

Conclusion

There are now an increasing variety of channels that Bitcoin owners can use, and the surge in WBTC is simply one indicator that more Bitcoin holdings are pouring through DeFi. The safety and sturdiness will determine the most effective Bitcoin DeFi networks and protocols.