Budgeting is a complete roadmap to create performance benchmarks for the business. The main objective is to set a time frame through creating a spending time to evaluate your financial status and determine whether you achieve your goals.

There are three types of budgets: balanced, surplus, and deficit. A balanced budget is a financial document for annual revenues. It outlays based on income and expenses.

A surplus budget is defined as a forecast or summary of the budget that promotes financial stability. Another type of deficit budget is the operational or current budget.

This capital makes saving money for necessary expenses like school, building an emergency fund, and making timely debt payments easier.

Furthermore, the budgeting process provides the business strategies to implement a corporation’s software objectives, gives performance measures for the firm plan, and acts as a comprehensive road map for that plan.

Additionally, Keeping balance is the only requirement for establishing a budget. The budgeting process found in a business plan is used to carry out a company’s software goals. Also, you can achieve your financial objectives through Spending and budgeting.

Budgeting App’s Features

- prediction of revenue and spending over a specific future period

- keep track of your income and expenses if you cannot buy the items you want

- provides performance indicators for the firm plan and serves as a thorough road map for that plan

- Set financial goals for some time, usually a year

- Assists in working towards long-term objectives that avoid Spending

Best Personal Finance Apps for Everyone

There are up to 10 Best Apps for Budgeting. The best alternative to 10-best-apps-for-budgeting is Mint, which is Paid. The other best apps like 10-best-apps-for-budgeting are YNAB, Goodbudget: Budget & Finance and Every Dollar.

Best Apps for Budgeting Information

10 Best Best Apps for Budgeting Alternatives

Filter Alternatives

1Personal Capital

Personal Capital is a finance website and wealth management system designed for managing personal assets. It is the configured and highly advanced solution for controlling money and organizing personal finance. The site enables users to adapt intellectual strategies for organizing finance and tracking investments. This website is developed on the idea of a double-entry system and allows people to link their accounts together. With the help of this site, you can easily analyze your portfolio anytime and see your net…

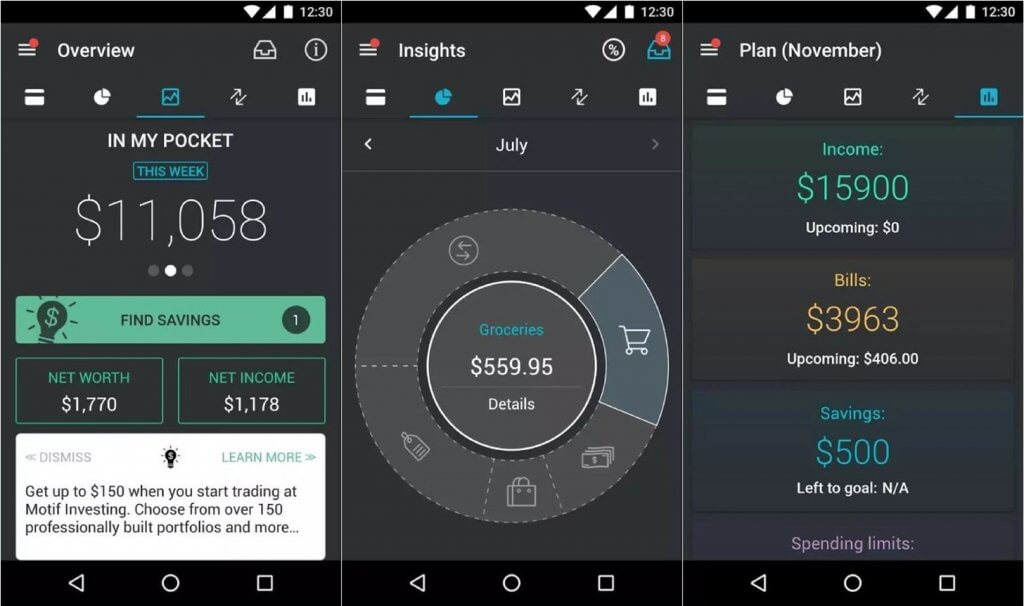

2PocketGuard

PocketGuard is a finance and budgeting app and tool developed by PocketGuard, Inc. This app is specially developed for planning and controlling finance. With the help of this site, you can grow savings, manage money, and optimize expenses. Using this app, people can calculate their savings after spending money from their income. This app has a bill organizing feature which identifies your bills automatically and notifies you before the due date. The app enables users to connect their loan and…

Advertisement

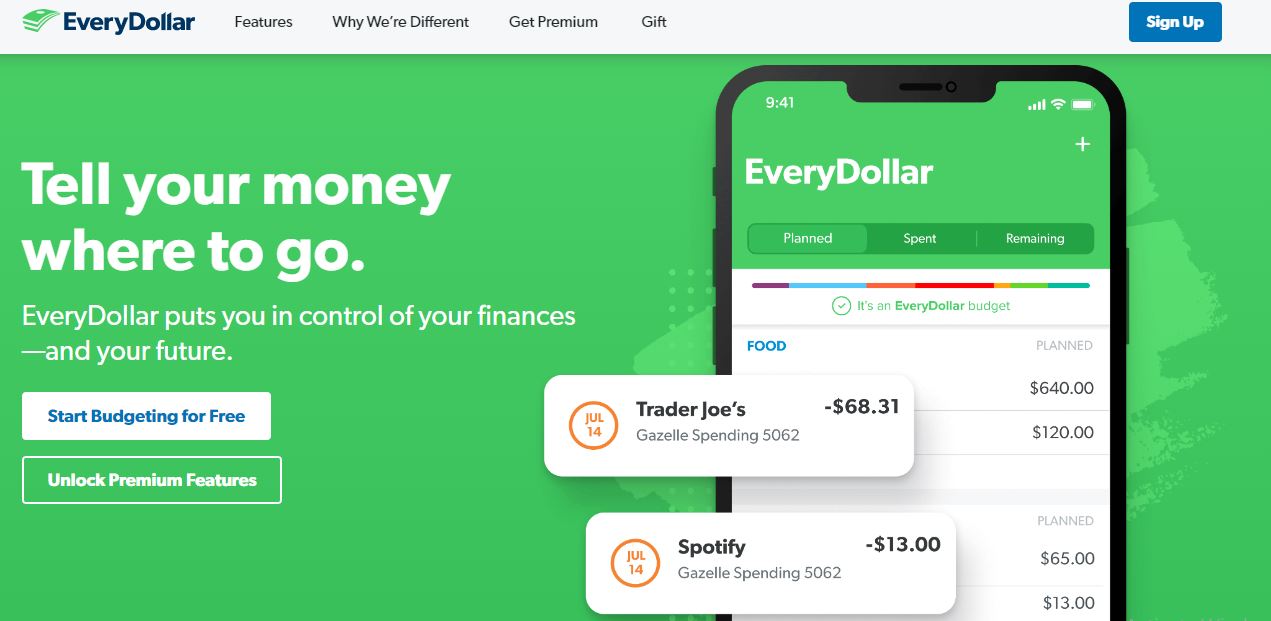

3Every Dollar

Every Dollar is a budgeting app that Ramsey Solutions developed. This app is used to help you take back control of your money and make a plan for spending it before your paycheck arrives. It helps you set up a Budget in just minutes. Every Dollar can also sync to your bank account and automatically import your transactions from your bank or credit card statements. All the communications between your device and EveryDollar.com are encrypted. It makes it easy to…

4Fudget

Fudget is an app that is used to create a simple list of income and expenditures items. You will be able to see always your balance at the bottom of the screen. It allows you to learn the interface in seconds and finally a budget. It has an expense tracking app that’s actually easy to use. To keep your personal finance information secure use passcode lock and log in. It enables people to choose the currency symbols for budgeting wherever…

Advertisement

5Goodbudget: Budget & Finance

Goodbudget: Budget & Finance is an app becomes with a feature to sync and share a budget. you will be able to see your total spending on the envelope. Through this app, users will be able to practice their conscious spending. You have the option to create a budget that works automatically. Bringing a plan before you spend money helps you to maintain all your needs. People have total information about their accounts. You will be able to choose your…

6Spendee

Spendee is an app, that allows people to help them with budgets to stick to their financial goals. It has a wallet to organize your cash, bank, accounts, or different financial occasions. With shared finances, you will be able to efficiently manage money with partners or flatmates. It provides you with multiple currencies to handle vacation finance with ease. You will have labels to mark and analyses transactions in more depth. You have a dark mode for the protection of…

Advertisement

7Stash Invest

Stash Invest is a personal finance app that simplifies the investing process while ensuring affordability, security, and authenticity for millions of users. Stash Invest includes automated investment tools that help users meet their financial goals efficiently. It also offers a secure banking system with a Stock-Back debit card that rewards users with stock from leading brands.

Empower: Instant Cash Advance is an app by Empower Finance that provides users with up to $250 in cash advances with no interest. The app also offers weekly deals that allow users to save money, including up to 10% cashback on online shopping.

9YNAB

YNAB (You Need a Budget) is an exceptional platform that helps users gain full control of their finances, regardless of their business size or type. The app enables users to stop living paycheck to paycheck, save more money, and eliminate debt. It has helped millions of people achieve financial stability and manage their money effectively.

10Mint

Mint is a web-based finance management tool that consolidates all your financial accounts into one place. It automatically categorizes transactions, helps schedule payments, and provides custom alerts for unusual charges, making it easy to stay on top of your finances.